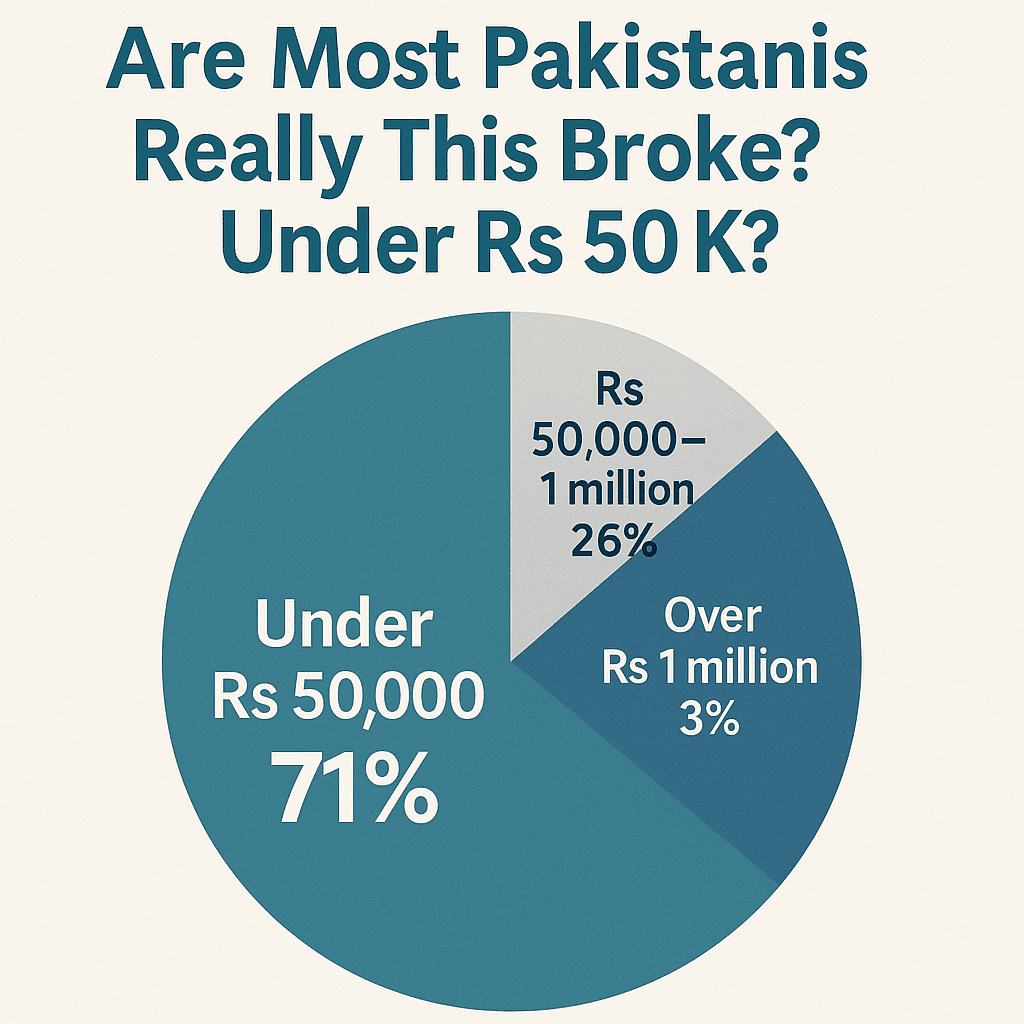

Over 70 % of bank accounts in Pakistan hold under Rs 50 000. Discover the hidden reasons, surprising facts, and smart ways to break free from low‑balance living.

Quick Snapshot — The Numbers Behind the Headline

| Balance band | Share of bank accounts |

|---|---|

| Under Rs 50 000 | ≈ 71 % |

| Rs 50 000 – 1 million | ≈ 26 % |

| Over Rs 1 million | ≈ 3 % |

More than seven in ten accounts are parked below the Rs 50 K line, proving that “low‑balance banking” is the norm, not the exception. humenglish.comstartuppakistan.com.pk

Why Do Balances Stay So Low?

1. Shrinking Real Incomes

After‐tax salaries have struggled to keep pace with double‑digit inflation, eroding the rupee’s purchasing power and leaving little to save.

2. Cash‑First Culture

Despite digital progress, many Pakistanis still trust cash for daily trade. “Mattress money” never reaches a bank ledger.

3. High Dependence & Informal Work

A large youth and elderly population plus widespread informal employment means one wage earner often supports multiple dependants, chopping any surplus.

4. Bank Fees & Mistrust

Per‑transaction SMS alerts, low‑balance penalties, and fear of zakat deductions deter small savers from parking money for long.

5. Inflation‑Hedging Behaviour

Those who can save often flip rupees into dollars, gold, or prize bonds, so balances appear low even for higher‑income households.

7 Little‑Known Facts About Pakistan’s Savings Landscape

- Digital leap: 89 % of retail transactions now flow through mobile or internet channels—proof that habits can change fast. thepublictribune.com

- Historical high: Total deposits smashed the Rs 32 trillion mark in April 2025, yet most of that cash sits in a tiny fraction of accounts. pkrevenue.com

- Insurance safety net: Up to Rs 500 000 per depositor is fully insured; 98.9 % of savers fall under that limit. incpak.comthenews.com.pk

- Women closing the gap: Female account ownership jumped from 23 % to 47 % in just five years. dawn.com

- Financial inclusion sprint: The share of all adults with an account soared from 16 % (2015) to 64 % (2023). dawn.com

- Policy ambition: SBP’s NFIS 2024‑28 aims for 75 % inclusion and a gender gap below 25 % by 2028. thenews.com.pk

- Instant rails: Pakistan’s Raast system handled 371 million transactions worth Rs 8.5 trn in Q3‑FY 2025—yet many users keep wallet balances near zero, topping up only when needed. thepublictribune.com

How Low Balances Hurt the Bigger Picture

- Credit starved SMEs: Banks prefer large corporate clients; thin retail deposits limit funds for small‑business lending.

- Shallow capital markets: When households don’t accumulate investable surplus, pension and mutual fund penetration stays minuscule.

- Macroeconomic fragility: In crises, people with no buffer pull cash abruptly, jolting liquidity and forcing costly policy rescues.

What Government & Banks Are Doing

| Initiative | What it tackles | 2025 status |

|---|---|---|

| Asaan Mobile Account | KYC hurdles | Over 9 m accounts opened |

| Raast P2P & P2M | Fee‑free instant payments | 371 m txns in latest quarter thepublictribune.com |

| Banking on Equality | Gender inclusion | 31 m women now banked dawn.com |

| Deposit Protection Rise | Public trust | 98.9 % savers fully covered thenews.com.pk |

Personal Game‑Plan: How to Cross the Rs 50 K Barrier

- Automate micro‑saves: Use a Raast‑linked wallet to skim 5 % off every incoming payment.

- Shift cash to a prize‑linked savings account: Several banks now offer lottery‑style returns on small balances.

- Leverage high‑yield term deposits: With the policy rate at 11 %, three‑month TDRs beat hiding cash at home.

- Budget with 50‑30‑20 rule: Needs 50 %, wants 30 %, future you 20 %. Start with 5 % if money is tight.

- Swap subscriptions for lump sums: Pay annual, not monthly, on unavoidable services; bank the discount difference.

Frequently Asked Questions

Q 1: Are 71 % of people or accounts below Rs 50 K?

The statistic covers accounts. Many Pakistanis hold just one, so the figure is still a close proxy for households. humenglish.com

Q 2: Is my money safe if it stays under Rs 500 K?

Yes; it’s fully insured by the Deposit Protection Corporation. incpak.com

Q 3: Will digital wallets replace bank accounts?

They complement banks. Wallets solve day‑to‑day payments; banks remain essential for term deposits, loans, and regulatory safety nets.

Q 4: How can I open an account with zero paperwork?

SBP’s Asaan Account lets you open one with just CNIC and a selfie via partner apps—no branch visit required.

Key Takeaways

Low balances are real, but not inevitable.

Structural reforms plus smart personal habits can push you past the Rs 50 K line—and help the economy in the process. Start with an automated micro‑save today and watch the compounding effect kick in.

Related reading: How digitisation is changing passport renewals — see our guide on https://dailyinformax.com/pakistani-passport-2024-fast-easy-secure-renewal/.